As manufactures continue to expand their global footprint, they realize the benefits and competitive advantages of manufacturing in regions with a more convenient geographical location.

For North American companies, this idea has growth in the last decade. The trade war between US and China and nowadays the coronavirus Pandemic brought back this concern and many countries realized the need of a new strategy for more diversified, less risky and more resilient value chains to grow.

Here are 10 reasons why Nearshoring to Mexico is the most valuable option:

Free trade in North America is guaranteed with the USMCA (NAFTA Update), with clear rules and a deeper integration among partners

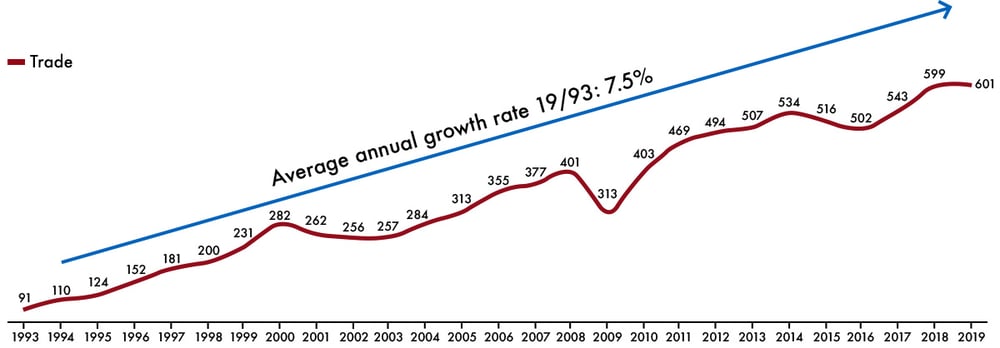

Mexico-NAFTA Trade

(Billion dollars)

Source: Banco de México

Besides USMCA, Mexico has 12 other Free Trade Agreements with 48 countries, which connect the Mexican economy to more than 1.3 billion consumers (60% of the world’s GDP).

Source: México Secretaria Economy

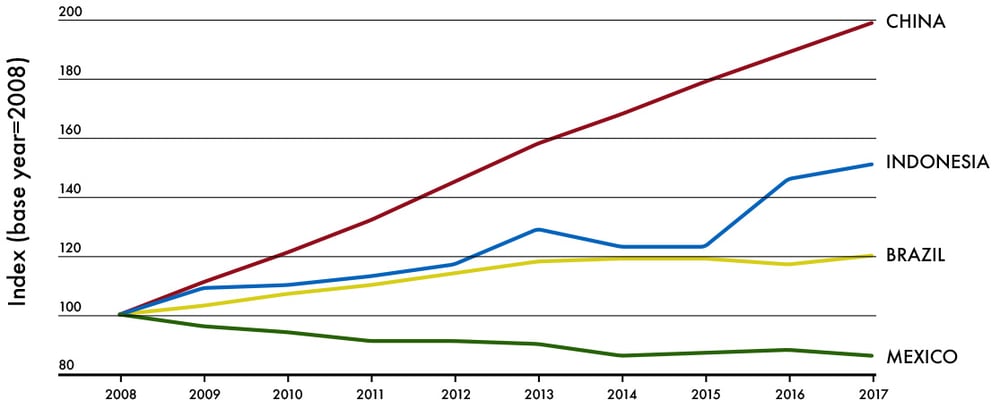

Since 2008 the trend to offshore production to Asia began to shift back to North America. Due to a large increase of Labor costs in China.

This increases impact directly the manufacturing sector, and factories with small margins are quickly moving to other competitive countries.

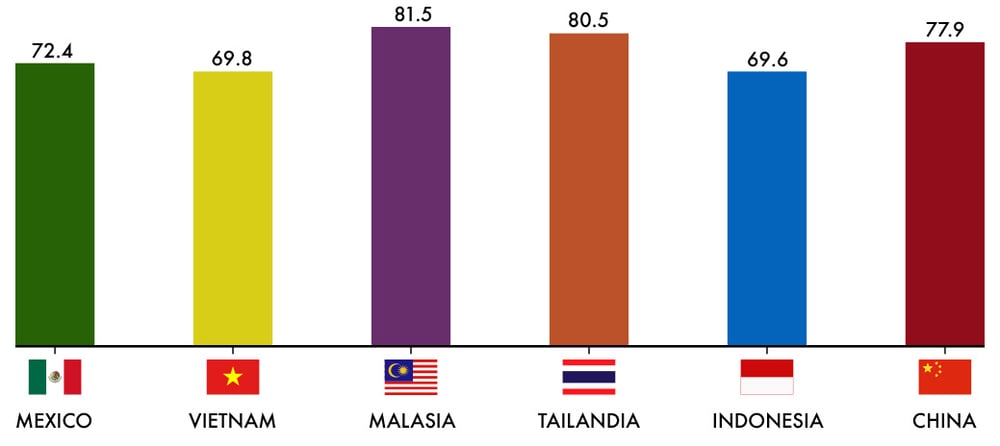

The USMCA includes an adjustment of labor salaries in the region, and even with this improvement, Manufacturing salaries in Mexico remain competitive.

Average real wage index for emergeing G20 countries, 2008-21

Source: ILO estimates

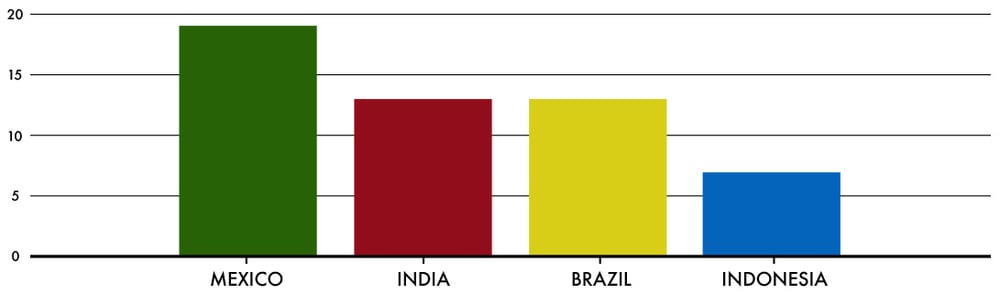

In the last decades, Mexico economic regions like Hidalgo- Mexico State and Bajio has been working in a close partnership between manufacturing clusters and universities to prepare a workforce that suit the labor needs.

The result of this effort is Mexico young, competitive and highly skilled workforce, With over 110,000 engineering and technical students graduating each year.

Share of graduates from engineering programs

Source: OECD

The difference in time zones has always been a significant issue with offshoring. And right know looks more attractive to manage a 3-hours maximum time difference, including a less travelling time and good connectivity between countries.

Quick Shipping, Efficient Logistic services, and fleet management in a better geographical location, allows all type of products to reach your clients faster.

Maritime days to selected destinations

| Destinatión | Mexico | China | India | Brasil | South Corea |

| New York | 5 | 32 | 25 | 15 | 21 |

| Los Angeles | 4 | 18 | 31 | 23 | 17 |

| Rotterdam | 16 | 32 | 20 | 17 | 33 |

| Yokohama | 19 | 4 | 17 | 35 | 3 |

Source: The Boston consulting Group in De La Madrid (2014)

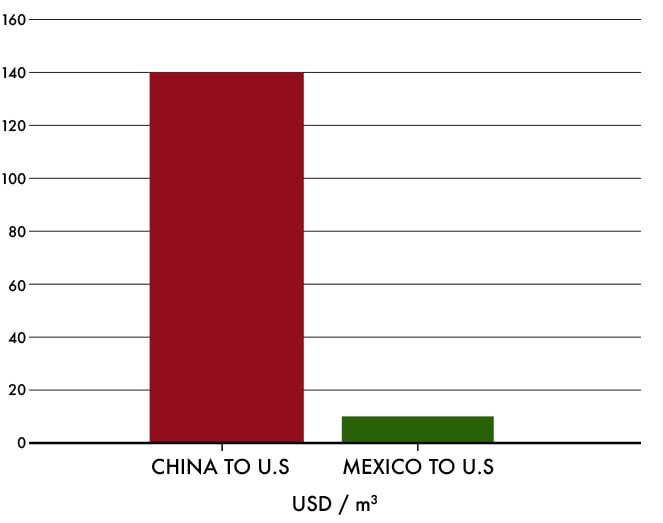

More than 50 entry ports between the U.S. and Mexico, will improve your logistic strategy, in comparison with high shipping costs between China and U.S.

Low shipping costs

Source: GMB Global Value Chains Disruptions

Rankings published by The Boston Consulting Group, PWC and Savills. Tells us that Mexico has a good position on competitiveness. Considering the low input costs, quality infrastructure and reliable services.

Ease of Doing Business Index

Source: PwC Analysis with data from The World Bank, Trading Economics and official statistics.

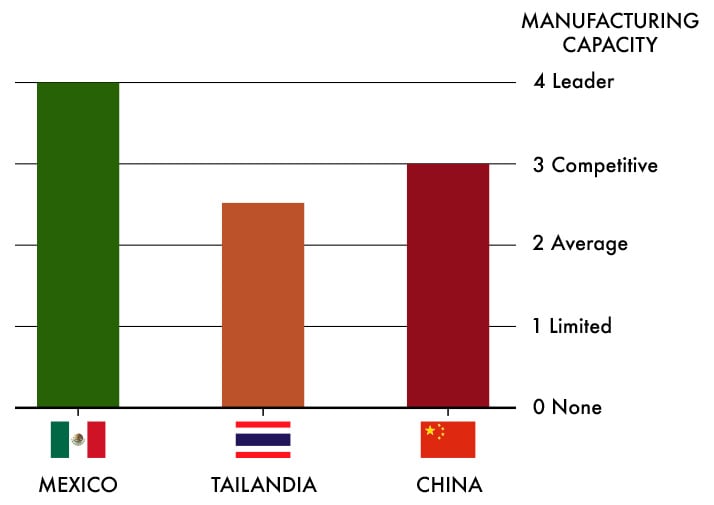

Mexico is a world leader in manufacturing sectors such as Automotive (4th global exporter), Aerospace (6th largest supplier of aircraft parts to the U.S.) and Medical Devices (8th largest exporter worldwide).

Manufacturing capacity, automotive sector.

Surce: PwC Analysis with data from The World Bank, Trading Economics and official statistics.

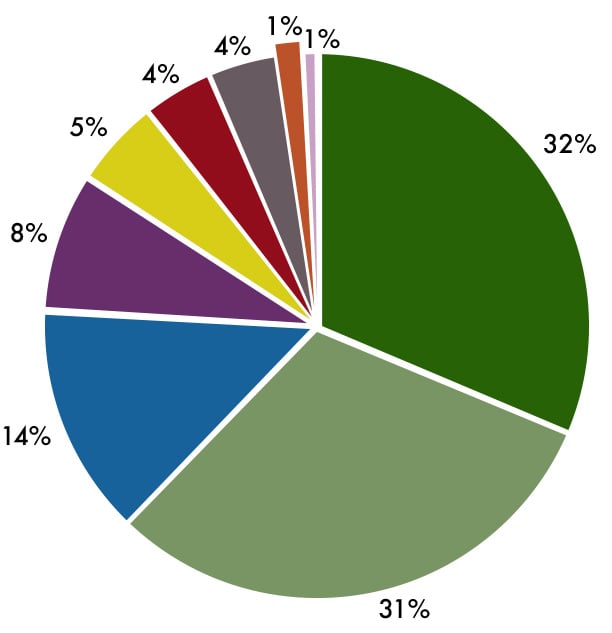

Mexican Industrial Real Estate market is the largest in Latin America. In Q2 2020 more than 23 million sq. ft. were available, with manufacturing sector as the main driver of the demand. Vacancy rates are in a 1.8% range and average asking price has remained in USD $4.94 over the last year.

Demand by industries, Q2 2020

Source: CBRE Market Research, Q2 2020

Sources

1. MEXICO – A TRUSTED ECONOMIC PARTNER. Mexico’ Secretariat of Economy (SE).

2. Distribution of graduates and entrants by Field. OECD.

3. Global Wage Report 2018/19. International Labour Organization.

4. Beyond China: How Could Mexico Benefit from a Rearrangement of the GSC. PwC.

And at Frontier, we have the products suited to your needs: